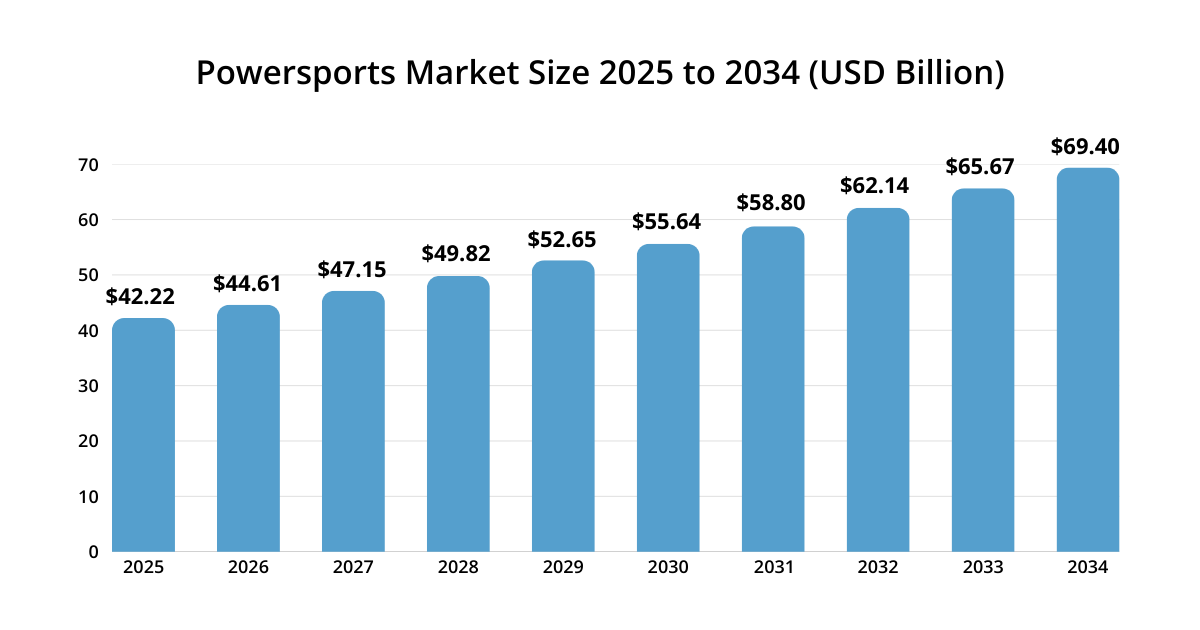

T he powersports industry is on a strong growth trajectory. Globally, the market is projected to rise from around $40 billion in 2024 to $69.4 billion by 2034[i], fueled by rising interest in outdoor recreation and advancements in off-road vehicle technology. North America alone makes up almost half of the global powersports market[i], with the U.S. sector expected to soar from $15.3 billion in 2024 to about $26.8 billion by 2034[i].

Powersports market size (global) from 2025 to 2034. The industry is expected to expand significantly, reaching nearly $69.4 billion worldwide by 2034[i].

This boom presents huge opportunities for companies offering extended warranties (also known as extended service contracts) on ATVs, motorcycles, UTVs and other powersport vehicles. At the same time, it brings unique challenges – especially in the “non-VIN” segment of the market, where many units don’t conform to standard 17-digit Vehicle Identification Number systems.

We’ll explore the challenges of the non-VIN powersports market and how the extended warranty business is evolving from three key perspectives: the Third-Party Administrator (TPA), the dealership, and the OEM (manufacturer). We treat each stakeholder equally and offer our view on the North American market, with some sources facts and proof points.

TPA Perspective: Data Hurdles and Growth Opportunities

From a Third-Party Administrator (TPA) point of view, the powersports warranty space can feel like the Wild West. Unlike the auto industry, where virtually every car or truck has a standardized 17-digit VIN, many powersports products have non-standard or shorter VINs (often just a 10-digit prefix) and inconsistent model classifications. These quirks create administrative headaches: legacy warranty systems might not recognize a 10-digit ID, and rating a contract’s risk becomes tricky when vehicle data is incomplete or formatted inconsistently[i]. In other words, “non-VIN” product administrators face unique challenges that slow down rating and contracting[i]. A dirt bike or personal watercraft might not slot neatly into the usual vehicle databases, forcing TPAs to manually adjust or build custom identification logic. This adds time and cost, and raises the risk of errors (e.g. quoting the wrong model or coverage terms) if not handled carefully.

A Booming Market Too Big for TPAs to Ignore

Yet, for all these data hurdles, TPAs see gold in the hills. The powersports segment is expanding rapidly and represents a relatively untapped market for service contracts. As noted, the U.S. powersports market will nearly double in size from 2024 to 2034[i]. Such growth means millions of new ATVs, side-by-sides, boats, and bikes coming off factory warranty and in need of protection. In fact, the overall extended warranty industry is booming – the U.S. extended warranty market (covering autos, electronics, appliances, and more) is projected to grow ~9.2% annually, from about $48.4 billion in 2024 to $116.7 billion by 2033[i]. This rising tide is prompting warranty administrators to expand their portfolios into powersports, RV, personal watercraft and other non-traditional categories. We’re already seeing new product offerings tailored to these segments; for example, in late 2023 EFG Companies launched a suite of new personal watercraft and powersports protection products (including an enhanced GAP coverage for powersport vehicles), aiming to boost dealerships’ back-end margins and give consumers more confidence in making these purchases[i].

Solving the Data Puzzle to Win in Powersports

To capitalize on the powersports wave, TPAs are investing in better data and technology. Modern warranty administration platforms are being upgraded to handle non-standard VINs and a wider array of vehicle types. Some are developing proprietary VIN-decoding tools or databases specifically for powersports, RVs, and equipment. Others collaborate with manufacturers to obtain build sheets or model catalogs that help standardize vehicle info for contract writing. The goal is clear: streamline the process so that issuing an extended service contract on a Kawasaki dirt bike or a Sea-Doo jet ski is just as instantaneous as on a Toyota Camry. Additionally, TPAs must adjust their actuarial models – off-road vehicles might have higher failure rates on certain components (due to harsh usage) but lower annual mileage, etc., requiring different rating assumptions than autos. Those administrators who solve the “VIN puzzle” and pricing complexities can gain a competitive edge in this growing market.

Tech and Partnerships: The Key to Non-VIN Growth

Finally, TPAs play a behind-the-scenes role that’s increasingly vital: ensuring regulatory compliance and risk management for powersports programs. Many U.S. states regulate service contracts, and rules can differ for on-road vs. off-road vehicles. Administrators need expertise in these nuances to keep programs running smoothly. They also must secure insurance backing (via contractual liability insurance policies or CLIPs) for the contracts they underwrite, especially as volumes grow. In short, the TPA viewpoint is that powersports warranties come with extra data challenges but also represent a fast-growing profit center if handled correctly. Solving those challenges – through tech innovation and partnerships – allows TPAs to unlock new revenue streams in the non-VIN arena.

Dealership Perspective: F&I Profit and Customer Value

Powersports dealerships across North America are also adapting to the rise of extended warranties. For dealers, selling extended service contracts is primarily an F&I (Finance & Insurance) opportunity – a way to boost per-unit profits and enhance customer satisfaction at the same time. This is especially important in today’s climate, where many powersports dealers face margin pressures. (Indeed, high interest rates have raised flooring costs and economic headwinds are affecting unit sales[i], so dealers are looking for every advantage to sustain profitability.) F&I products, like extended warranties, have become crucial to dealership profit; in the automotive world, they grew from 45% to 53% of dealers’ gross profit on average over the last few years[i], and while powersports operations are smaller, the principle is similar.

The beauty of these products is that they often carry very healthy margins – historically, service contracts exhibit low loss ratios (i.e. a low percentage of customers ever making claims)[i]. Many warranty programs see loss ratios around 50%, which means only half the premium typically comes back as claims cost, leaving the rest as profit for the underwriters or reinsured dealer. Dealers know that each extended warranty sold is largely pure upside (especially if they participate in underwriting profit via reinsurance or retro programs).

As one industry expert explained: “Dealers like F&I products because historically they have low loss ratios… The dealer gets to pocket the difference between claims paid out and premiums received.”[i]

In some cases, savvy powersports dealers set up reinsurance companies to actually own the service contracts they sell, capturing the long-term profit themselves – which can easily add hundreds of dollars of extra profit per unit sold when done right[i].

When the Thrill Gets Pricey

But beyond the dollar signs, how do extended warranties benefit a powersports dealer’s customers? To put it simply: these vehicles break a lot – and fixing them isn’t cheap. A high-performance ATV or a touring motorcycle is not a garage queen; owners use them hard, often in rough off-road conditions, subjecting them to abuse that no regular passenger car undergoes[i]. By design, powersports are meant to be pushed to their limits (mud, sand, jumps, racing, etc.), which inevitably leads to wear and tear or mechanical failures. Yet the manufacturer’s warranty on many powersport units is relatively short – often just about one year for an ATV or side-by-side[i]. That leaves a lot of riding time unprotected, and Murphy’s Law suggests major issues tend to crop up after the factory coverage expires. Without an extended service plan, an enthusiast could be on the hook for an engine rebuild or transmission replacement out-of-pocket. It doesn’t help that repair costs have been climbing steeply; one industry report noted vehicle repair costs jumped 20% in a recent year, far outpacing general inflation[i]. Specialized powersports parts and labor can be particularly pricey due to smaller distribution networks and high-performance components. For example, a blown UTV engine or a failed suspension can run thousands of dollars to fix. Riders who finance their purchase might not be prepared for such surprise expenses.

Peace of Mind that Drives Loyalty

This is why dealers often stress extended warranties as part of the sales process. It’s about peace of mind for the customer. Salespeople and F&I managers will remind buyers that “if something big goes wrong a couple years down the road, you’re covered – no worrying about a $3,000 repair bill, just bring it in and we’ll take care of it.” A well-presented warranty option can thus enhance customer satisfaction and loyalty (the buyer feels the dealership is looking out for their long-term interest). Dealers also know that a customer with a service contract is more likely to return for authorized service and potentially their next purchase. In terms of numbers, many auto dealerships manage to sell extended warranties to roughly 40% of customers[i]. Powersports has historically trailed that, but the gap is closing as dealers improve their F&I process for bikes and ATVs. With proper training and integration, some top-performing powersports dealers now reach automotive-like penetration rates. Industry publications share best practices like introducing the idea of extended protection early in the sale, transparently explaining the rough usage of these vehicles, and even bundling service plans into financing. The result is a win-win: riders get to enjoy their toys with less worry, and dealers gain a valuable revenue stream while also fostering goodwill.

As one dealer consultant put it, a strong warranty program is “a strategic investment in customer retention and dealership profitability,” not just an add-on[i].

Extended Coverage Becomes the New Standard

In summary, the dealership perspective on powersports extended warranties is that they are increasingly indispensable. Given the economic ups and downs, having a robust F&I product offering can smooth out volatility in sales. Many dealerships, whether selling snowmobiles in winter or jet-skis in summer, are putting more emphasis on training F&I managers to convey the value of coverage. And it’s paying off – dealers report higher per-unit profits and customers who feel more confident about their purchase. The key challenge remains education: overcoming any buyer hesitation (some hardcore enthusiasts think they can fix anything themselves, or are initially price-sensitive). However, as more success stories circulate of a warranty saving someone thousands on a blown engine, consumer attitudes are shifting. In the North American market, where disposable incomes are solid and usage is high, extended service contracts are becoming a standard part of the powersports ownership experience – much like they are in the automotive world.

OEM Perspective: Extending Brand Trust and Revenue

For Original Equipment Manufacturers (OEMs) of powersports vehicles – companies like Honda, Polaris, Yamaha, BRP, Harley-Davidson, and others – the rise of extended warranties in their domain presents both an opportunity and a strategic decision. Historically, many OEMs left extended service contracts to third parties or dealers. However, with the market maturing, manufacturers are increasingly getting directly involved in offering their own branded protection plans. This allows the OEM to capture additional revenue, ensure a consistent customer experience, and strengthen brand loyalty.

OEM-Backed Warranties Drive Loyalty

A great example is Honda’s HondaCare Protection Plans for powersports. Honda now advertises that you can get up to 5 years of additional coverage on select models beyond the standard warranty[i] – essentially a factory-backed extended warranty for motorcycles, ATVs, side-by-sides (SxS) and more. Likewise, Yamaha has its Y.E.S. (Yamaha Extended Service) program for bikes and WaveRunners, and nearly every major manufacturer has some equivalent: Harley offers extended service plans, Kawasaki has Good Times Protection, BRP covers Ski-Doos and Can-Am products with extended warranties, etc. By providing these plans themselves (often sold at the dealership but under the OEM’s name), manufacturers aim to keep customers “in the family.” If a buyer knows the extended warranty is backed by the vehicle’s maker, it can increase their confidence in the brand’s reliability and commitment. It also tends to drive customers back to authorized dealerships for repairs (since the OEM plans usually require or encourage using the dealer network for service), which in turn boosts parts sales and dealer service revenue. It’s a virtuous cycle: the customer feels taken care of, the dealer gets service business, and the OEM potentially sells more parts and even enjoys a higher likelihood of the customer’s next purchase being the same brand.

From the OEM’s perspective, extended warranties can indeed be a brand loyalty tool. Studies in retail have shown that offering a robust warranty or protection plan builds trust and encourages repeat business[i].

In the words of one warranty provider, “Extended warranties are the bridge that connects you to your customers long after the initial purchase. By offering a safety net and support in times of need, you become more than just a manufacturer — you become a trusted ally, ensuring that your customers keep coming back.”[i]

This emotional bond is extremely valuable in the powersports world, where enthusiasts form attachments to brands (think of the Harley vs. Indian loyalty, or the Polaris vs. Can-Am rivalries). If an OEM-backed extended warranty gives a rider peace of mind for, say, 4-5 years of dirt bike racing, that rider is more likely to stick with that OEM for their next upgrade, because they know the company will stand behind them if something goes wrong.

A Win-Win for Brand and Bottom Line

There is also a financial incentive for OEMs to offer extended service programs. These plans can be profitable on their own (when priced correctly and with low claim rates), or at least break-even while driving other profit centers (like the aforementioned parts/service). Some OEMs operate their warranty programs through their finance divisions or captive insurance arms, effectively acting as the obligor/insurer for the contracts. Others partner with experienced TPAs or insurers to administer the programs on the back end, while the OEM handles marketing and branding. For instance, an OEM might use an insurer to issue a CLIP (Contractual Liability Insurance Policy) that covers the risk of the extended warranties they sell – this way, the OEM can offer a multi-year extension without keeping massive reserves on its own balance sheet. Many OEM programs are essentially a collaboration: the manufacturer provides the specs (which models, which coverage, etc.), and a specialized warranty administrator handles claims adjudication and compliance, often invisibly under the OEM’s brand name.

This setup has become easier and more common; as one industry resource notes, “It’s never been easier for a manufacturer to build an in-house service contract program,” thanks to partners that offer “TPA-in-a-box” solutions[i].

In North America, we’ve seen an increase in such OEM-branded offerings over the last decade as powersports companies realize they can ill-afford to ignore this growing slice of the pie.

That said, OEMs also face the challenge of non-VIN data in powersports, albeit in a different way than TPAs. A manufacturer obviously knows its own products’ serial numbers and specs, but when it comes to resales or used units, tracking those for extended coverage can be difficult without the robust VIN-based history that auto OEMs enjoy. Some powersports OEMs are investing in better product registration systems or encouraging owners to register their vehicles, so that even off-road units are accounted for in a database for recalls and warranty extensions. Over time, industry standards may improve (perhaps powersports will move toward full 17-digit VINs universally), but until then, OEMs must often rely on dealers to verify vehicle details when selling an extended plan on a unit. Despite these hurdles, the trend is clear: extended warranties are expanding in the powersports vertical, and OEMs are embracing them as part of their customer experience strategy.

A Win-Win for the Customer and Industry

In conclusion, from the OEM viewpoint, offering extended warranties is a way to stand behind the product and reinforce quality, while also keeping customers tied to the brand’s ecosystem. It generates incremental revenue and can even be a marketing differentiator (“Buy our ATV and get the option for 5 years total warranty coverage – best in the industry!”). As the powersports market in North America continues to grow and evolve, expect OEM-backed service contract programs to become as commonplace as they are in the auto sector. In the end, all three parties – TPAs, dealers, and OEMs – have a stake in the success of powersports extended warranties, and by working in concert they can overcome the non-VIN challenges and deliver a win for the customer as well as the industry.

PresentNow – Experience It First-Hand

To thrive in this market, you need the right tools and partners. PresentNow is here to help all stakeholders streamline the extended warranty process for powersports, RV, and personal watercraft.

Sign up for a demo of PresentNow today and see how it can elevate your F&I presentations, data handling, and customer experience in the non-VIN world. Let us show you how to turn these industry challenges into opportunities – schedule your demo now!